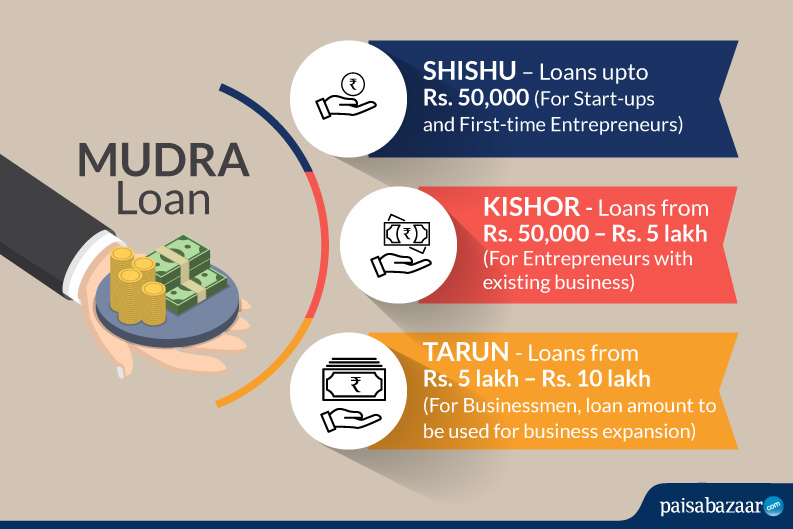

In India, micro, small, and medium enterprises (MSMEs) are known to be the backbone of the country’s economy. While these businesses play a significant role in keeping the Indian economy afloat, they are often unable to avail financing to meet their business needs. MSMEs in India often struggle to secure funds for growing their business as they lack the tools and the ability to secure them. To make it easier for MSMEs to secure loans, the Indian government had launched the Pradhan Mantri Mudra Yojana (PMMY) in 2015. Under this scheme, eligible business owners can avail up to Rs. 10 Lakhs to meet their business expenses. The entire process is extremely simple and convenient. It has been made even easier for businesses to avail the mudra loan through the digitalisation of the process through e-Mudra, making it easier to apply for the loan online and quickly.

Table of Contents

How to Use Mudra Loan to Expand your Business

The Mudra loan is exclusively meant for MSMEs to meet their business needs. There are several ways in which the e mudra loan can be utilised. Read on below to learn a few tips on how the Mudra loan can be used efficiently and productively.

- Purchase New Machinery:

For setting up any industrial unit, machinery is often the first component that needs to be purchased. Even after the unit has been functional for a while, there is always a need for buying new machinery since machinery tends to get a lot of wear and tear while usage and experiences depreciation. With a Mudra loan, you can opt to get new machinery that increases your output, reduces your costs, and helps you grow your business further. - Purchase Tools and Equipment:

There are several kinds of tools and equipment that ensure the smooth operation of a business. Regardless of the type of business you have, you might be required to buy certain kinds of tools and equipment. This could include machines such as computers or printers for your office or even setting up utilities such as telephones. Stationery is also an important component of the office since employees require these tools to get their work done. By applying for an e-Mudra loan, you can easily purchase these tools and equipment. - Purchase Transport Vehicles:

Vehicles play an integral role in helping businesses operate and flourish. For businesses that manufacture products, vehicles help in the transportation of their finished goods and in delivering them to customers. The e-Mudra loan helps you reduce your overall transportation costs and turn a higher profit by offering funds for buying vehicles. You can also use vehicles to make employees’ transit easier. The Mudra loan amount can be used to purchase vehicles for your business, including a two-wheeler, a three-wheeler, or a tempo. Additionally, you can deem these vehicles as fixed assets and even earn depreciation benefits on them. - Purchase Raw Materials:

Raw materials are important in every business, but raw materials’ supply and prices hold even more importance for manufacturing enterprises. You can use the Mudra loan to buy raw materials, which can help you increase your efficiency, costs, and overall profitability. Raw material can also include products that you require in your office to keep it running. - Purchase Furniture:

Businesses require offices and furniture for the staff to conduct operations. The e-Mudra loan can be used to buy furniture for your shop or office. Along with furniture, you can get the necessary fixtures and equipment for your workspace. This will not only enhance your staff’s productivity but also help impress your clients when they visit your office or shop.

Conclusion

Many MSMEs in India have had to stop operations over the years and declare bankruptcy as they were unable to find funds to expand their business. Growing a business can often be expensive, and access to funds can play an important part in determining whether the business succeeds or is forced to fail. With the Mudra loan, the Indian government has eased procedures to enable small business owners to access funds easily. Now, they can access capital loans of up to Rs. 10 Lakhs and give their business the necessary push it requires to operate seamlessly and generate profits.